Kazakhstan, a landlocked nation straddling Eastern Europe and Central Asia, has emerged as a significant player in the cryptocurrency mining landscape. This burgeoning industry, however, operates within a complex regulatory framework, particularly when it comes to customs regulations for mining machine hosting services. Navigating these regulations is crucial for businesses seeking to establish or expand their presence in this promising market.

The allure of Kazakhstan as a mining hub stems from several factors, including its relatively low electricity costs (historically, although this is subject to change), its cold climate conducive to efficient cooling of mining equipment, and the government’s initial openness to the industry. However, this openness is tempered by a desire to regulate and tax the industry, ensuring a fair contribution to the national economy.

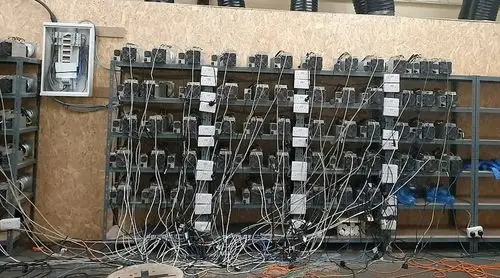

Understanding the customs regulations is paramount. These regulations govern the import and export of mining equipment, including Application-Specific Integrated Circuits (ASICs), Graphics Processing Units (GPUs), and related hardware. Incorrectly declaring goods or failing to comply with documentation requirements can lead to significant penalties, including fines, seizure of equipment, and even legal action.

The first step in complying with Kazakhstan’s customs regulations is to accurately classify the mining equipment being imported or exported. This classification determines the applicable tariffs, taxes, and other duties. Misclassification, whether intentional or unintentional, can result in underpayment of taxes and subsequent penalties. Consulting with customs brokers or legal professionals specializing in this area is highly recommended.

Furthermore, meticulous documentation is essential. This includes providing accurate invoices, packing lists, certificates of origin, and other supporting documents. These documents must clearly identify the goods being shipped, their value, and their intended use. Any discrepancies or omissions can raise red flags and trigger customs inspections and delays.

Beyond import duties and taxes, Kazakhstan also regulates the movement of virtual assets, including cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and even meme coins like Dogecoin (DOGE). While the legal status of cryptocurrencies is still evolving, it’s crucial to understand how these regulations may impact mining operations, particularly when it comes to repatriating profits or using cryptocurrencies for international transactions. The legal landscape surrounding cryptocurrencies and mining is dynamic, with regulations subject to change based on governmental policy adjustments and evolving market conditions. Staying informed about the latest updates and seeking legal counsel is crucial for sustainable operation.

Mining machine hosting services play a vital role in the Kazakhstan ecosystem. These services provide infrastructure, security, and technical support for miners who prefer to outsource these functions. However, hosting providers must also comply with customs regulations related to the import and export of their clients’ equipment. This requires careful coordination and communication between the hosting provider and the client.

Moreover, hosting providers may also be subject to additional regulations related to data security, anti-money laundering (AML), and know-your-customer (KYC) requirements. These regulations are designed to prevent illicit activities and ensure the integrity of the cryptocurrency ecosystem. Failure to comply with these regulations can result in severe penalties, including loss of licenses and reputational damage.

One critical aspect of compliance is transparency. Businesses operating in Kazakhstan’s cryptocurrency mining sector must be transparent with regulators and law enforcement agencies. This includes providing accurate information about their operations, their clients, and their financial transactions. Any attempt to conceal information or mislead regulators can have serious consequences.

Building strong relationships with local authorities is also essential. This includes engaging with customs officials, tax authorities, and other regulatory bodies. Proactive communication and a willingness to cooperate can help to build trust and resolve any issues that may arise. Investing in local partnerships and advisors can provide invaluable guidance and support in navigating the regulatory landscape.

Furthermore, businesses should implement robust internal controls and compliance programs. These programs should include policies and procedures for customs compliance, AML/KYC compliance, data security, and financial reporting. Regular training for employees and ongoing monitoring of compliance activities are also crucial.

The future of cryptocurrency mining in Kazakhstan remains uncertain. While the government initially embraced the industry, recent concerns about energy consumption and environmental impact have led to increased scrutiny and potential regulatory changes. However, Kazakhstan remains a significant player in the global mining landscape, and businesses that are willing to invest in compliance and build strong relationships with local authorities can still thrive in this dynamic market.

In conclusion, complying with Kazakhstan’s customs regulations for mining machine hosting services is a complex but essential undertaking. By understanding the regulations, implementing robust compliance programs, and building strong relationships with local authorities, businesses can navigate the regulatory landscape and unlock the potential of this promising market.

One Comment

This guide on navigating Kazakhstan’s customs for mining machine hosting is insightful, blending legal intricacies with practical tips. However, it overlooks evolving crypto regulations and geopolitical risks, leaving room for more dynamic, real-time updates.